banks

From Wikipedia, the free encyclopedia

The history of banking began with the first prototype bank,s which were the merchants of the world, who gave grain loans to farmers and traders who carried goods between cities. This was around 2000 BC in Assyria, India and Sumeria. Later, in ancient Greece and during the Roman Empire, lenders based in temples gave loans, while accepting deposits and performing the change of money. Archaeology from this period in ancient China and India also shows evidence of money lending.

Many histories position the crucial historical development of a banking system to medieval and Renaissance Italy and particularly the affluent cities of Florence, Venice and Genoa. The Bardi and Peruzzi Families dominated banking in 14th century Florence, establishing branches in many other parts of Europe.[1] The most famous Italian bank was the Medici Bank, established by Giovanni Medici in 1397.[2] The oldest bank still in existence is Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, which has been operating continuously since 1472.[3] Until the end of 2019, the oldest bank still in operation was the Banco di Napoli headquartered in Naples, Italy which had been operating since 1463.

Development of banking spread from northern Italy throughout the Holy Roman Empire, and in the 15th and 16th century to northern Europe. This was followed by a number of important innovations that took place in Amsterdam during the Dutch Republic in the 17th century, and in London since the 18th century.

During the 20th century,developments in telecommunications and computing caused major changes to banks’ operations and let banks dramatically increase in size and geographic spread. The financial crisis of 2007–2008 caused many bank failures, including some of the world’s largest banks, and provoked much debate about bank regulation.

Banks have played an important role in the economic development of Katanning throughout its history. Some of the banks and bank buildings have been here for over 100 years although business names may have changed.

.

BANK BUILDING

When is a bank not a bank?

Bank Building (1909) Clive Street

The “Bank Building” was constructed in 1909 and, although it has never housed banking institutions, it has been utilised for other commercial purposes including a bakery (it still contains the original bakers oven) as well as a tailor shop. The Bank Building has also housed PM’s Restaurant, Katanning Family Steakhouse, and Taylor’s Family Restaurant to name a few, and has living quarters upstairs.

According to the inHerit website it is a restrained Federation Italianate two-storey building of three shops and residences with its exterior little altered. It has a panelled balustrade to the parapet with a curved pediment over the central bay with “Bank Buildings AD 1909” in bas-relief. The brickwork is tuck-pointed and the upper windows are double hung sashes.

The original timber shop fronts are in place along with its original bull nosed verandah and it has pressed metal ceilings and timber floors with arches joining all three shops. The garage and shed were re-roofed with steel in May 2001.

.

UNION BANK

From Wikipedia, the free encyclopedia

The Union Bank of Australia was an Australian bank in operation from 1837 to 1951. It was established in London in October 1837 with a subscribed capital of £500,000. The foundation of the bank had followed a visit to England by Van Diemen’s Land banker Philip Oakden with a view to forming a large joint stock bank operating across the Australasian colonies, during which time he gained the support of businessman and banker George Fife Angas who had founded the South Australian Company. The new bank absorbed Oakden’s struggling Launceston-based Tamar Bank upon his return, and opened its first branch in the former Tamar Bank premises on 1 May 1838. It expanded into Victoria on 18 October 1838, when it acquired the Melbourne business of the Tasmanian Derwent Bank, which had been the first bank in the city. It then opened its first Sydney branch on 2 January 1839. In 1840, it opened its first New Zealand branch in Wellington. In its early years, it had an agreement with the original Bank of South Australia, of which Angas was also a director, not to open branches in that colony; however, an Adelaide branch was established in 1850. A Brisbane branch opened in 1858 and a branch in Perth followed in 1878.

It became the Union Bank of Australia Limited in 1880. The bank remained open throughout the economic crises of the 1890s. It acquired the Bank of South Australia in 1892. By its centenary in 1937, it had 267 branches and agencies through Australia and New Zealand. It merged with the Bank of Australasia to form the Australia and New Zealand Bank Limited in 1951.

.

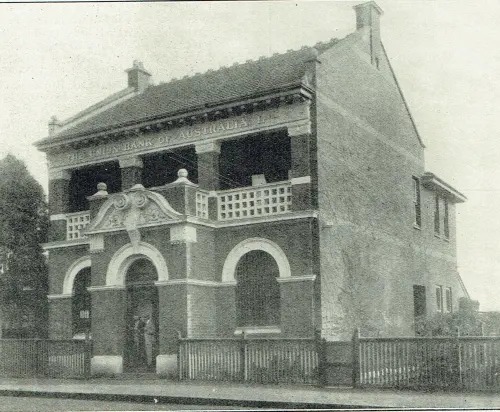

UNION BANK BUILDING – KATANNING

Union Bank Building

Clive Street East

When the Union Bank commenced business in Katanning in 1904, it became one of three banks in the town. The bank was situated in the building vacated by W J Rogers, who had built a new store and quarters. The first manager was N J Treleavan.

In 1911 the bank erected its own premises. This large two-storey structure consisted of banking chamber, manager’s room and strong room, as well as a commodious private residence for the manager and his family.

In 1931 Treleavan was succeeded by F W Skevington, then in 1934 Mr N W Broun was appointed. The first customers of the Union Bank were Ross and Thomas Anderson. In the early 1950s the Union Bank and the Australasia Bank merged to form the ANZ Bank.

ANZ Bank merged with English, Scottish and Australian Bank in 1970 to become Australia and New Zealand Banking Group Limited. Read more

UNION BANK OF AUSTRALIA

Union Bank of Australia Limited was an Australian commercial bank with British roots. It operated in Australia and New Zealand and merged with the Bank of Australasia in 1951 to become the Australia and New Zealand Bank (ANZ). Continue reading

.

BANK OF AUSTRALASIA

The history of the Bank of Australasia in West Australia has two chapters – the first runs between 1841 and 1846, when a branch was established in Perth. Mick Vort Ronald’s research indicated that there was “strong local support” for the Western Australian Bank at that time, and that the Perth branch of the Bank of Australasia was closed in 1846.

Continue reading

.

COMMONWEALTH BANK BUILDING

The site that the Commonwealth Bank building now stands has a long history of commercial use. The bank represented the economic growth and stability of the Shire of Katanning and its survival through the Depression years.

Just after marrying in July 1894 and joining his family at Katanning, Paul Beeck pitched his tent on vacant land in Clive Street where the Commonwealth Bank now stands. In 1935 the land was sold to the Commonwealth Bank.

The present Commonwealth Bank building was erected in the mid to late 1930s. In 1966 the bank underwent extensions costing more than $40,000. The extensions included the addition of a single storey to the western side of the building, as well as extensions to the rear to provide more office space.

The Great Southern Herald reported on the activity: When the work was completed, the main entrance to the bank would be located in the new section facing Clive Street. This would open into some 400 square feet (37 sq m) of public space. A special parking area for bank clients would be provided behind the premises with a separate entrance leading in from the car park.

New office accommodation would be provided for the Branch Manager and the room now used by him would be taken over by the Development Bank Field Officer. Office space would also be provided for his own staff. [GSH, 1/7/66,p. 1]

The new extensions also allowed for an interview room, voucher room, storeroom, staff room and new staff toilets.

The building also has some architectural and aesthetic significance, despite the 1960s extensions, which are fairly non-intrusive. Originally a symmetrical brick and tile two-storey building with prominent vertical piers utilised for the entry the building also features strong vertical and horizontal vertical lines and curves.

The front elevation is treated in a symmetrical ABA rhythm, with the central bay being the dominant feature. Using stripped down classical organisation, decorative motifs such as fluted recessed reveals, panels and frieze have been applied in the Modern or Deco manner.

HISTORY

From Wikipedia, the free encyclopedia

See also: Reserve Bank of Australia

The Commonwealth Bank of Australia was established by the Commonwealth Bank Act 1911, introduced by the Andrew Fisher Labor government, which favoured bank nationalisation, with effect on 22 December 1911. In a rare move for the time, the bank was to have both savings and general bank business. The bank was also the first bank in Australia to receive a federal government guarantee. The bank’s earliest and most strenuous proponent was the flamboyant American-Australian Labor politician, King O’Malley, and its first governor was Sir Denison Miller.

The bank opened its first branch in Melbourne on 15 July 1912. In an agreement with Australia Post that exists to this day, the bank also traded through post office agencies. In 1912, it took over the State Savings Bank of Tasmania, and by 1913 it had branches in all six states. Read the full history HERE

In 1916, the bank moved its head office to Sydney. It also followed the Australian army into New Guinea, where it opened a branch in Rabaul and agencies elsewhere.

.

WESTPAC BANK BUILDING

Formerly Bank of New South Wales

Western Australian Bank – Clive Street West

1837 – Bank of Western Australia

The Bank of Western Australia (1837 – 1841) was founded by George Leake, a leading merchant in the Swan River Colony of the time. The establishment of this bank was warmly welcomed in the colony’s newspaper:

“It has been our ambition, for some few years, to obtain assistance from abroad, and many efforts were made; but we were not sufficiently advanced to effect it. At length from our own resources, it is accomplished. We heartily congratulate our brother colonists upon this bright feature in the annals of our colonial history.”

.

1841 – Western Australian Bank

Shortly after the merger of the Bank of Western Australia and the Bank of Australasia, George Frederick Stone led a number of the 51 former shareholders of the Bank of Western Australia that had voted against the merger chose to establish another bank, named the Western Australian Bank.

1927 – Amalgamation with the Bank of New South Wales

The Bank of New South Wales [2] made it’s first “tentative and informal approach” to acquire the bank in 1924, the first formal offer was made in January 1927.At that time, the WA bank had 84 branches and sub-branches in Western Australia. Amalgamation with the Bank of New South Wales was complete by March 29th, 1927, which brought to an end a local institution “that had so long identified with the life and fortunes of this state.” Read the full report HERE

Bank of New South Wales/Westpac Bank

The Westpac Bank (formerly known as the Bank of New South Wales) represents the economic growth of Katanning, being one of many banks established in the Shire along Clive Street, although this bank building is located on the western side of the railway line.

In 1910, a branch of the Bank of New South Wales was opened in Albion Street, then G W Cussen set up temporary premises for the bank in Clive Street. In December 1911, Porter & Thomas Architects from Perth, called for tenders for alterations and additions to the Bank of New South Wales, which were completed in 1912.

Westpac Bank today 2021

In December 1911, Porter & Thomas Architects from Perth, called for tenders for alterations and additions to the Bank of New South Wales, which were completed in 1912. In 1927, the Bank of New South Wales absorbed the Western Australian Bank.

The original building is a three bay frontage with a tiled gambrel roof and stucco facade, symmetrically disbursed around a pedimented central bay with rusticated pilasters and engaged ionic columns. The double hung windows appear to have been replaced. The design style could be described as Federation Free Classical and a later addition to the left is more or less in keeping with the original building. An ATM (automatic teller machine) was installed at the front of the building in October 2000.

.

History of The Bank of New South Wales

(Westpac Group)

Westpac has a long and proud history as Australia’s first and oldest bank. It was established in 1817 as the Bank of New South Wales under a charter of incorporation provided by Governor Lachlan Macquarie. In October 1982 it changed its name to Westpac Banking Corporation following the acquisition of the Commercial Bank of Australia.

When it opened its doors for business the first employee was Joseph Hyde Potts. As a porter and servant, he received a weekly ration from the King’s stores and an annual salary of 25 pounds.

The 1800s

This was a challenging time, beginning with a serious loss in 1821 when it was discovered that the Bank of NSW’s Chief Cashier had stolen half its subscribed capital, none of which was ever recovered.

The Bank’s major expansion began in response to the gold fever in 1851 when it saw an opportunity to set up gold-buying agents in response to the needs of miners and merchants. It had grown from a single office in Sydney to a network of 37 branches by 1861.

The 1900s

The crash of the New York stock market on Black Thursday, 24 October 1929 signalled the start of the depression in the international market. The first significant sign of this in Australia came in January of that year, when Alfred Charles Davidson became general manager.

Davidson advocated a bold initiative to adjust the exchange rate on London downwards from par to £A130 = £100stg in 1931. This helped soften the impact of the depression on Australia and spark the ailing economy into recovery.

Following the acquisition of the Commercial Bank of Australia in 1982, Westpac expanded rapidly in the 1980s. However, as a result of the economic downturn at the end of the decade, Westpac declared a loss of $1.6 billion for the financial year ended 30 September 1992.

From 1993 to 1999, under the leadership of Robert (Bob) Joss, Westpac underwent a substantial rejuvenation program and then instigated a number of acquisitions in Australia and New Zealand to expand its retail footprint in markets where it was underweight, acquiring:

Challenge Bank Limited, Western Australia in 1995

Trust Bank New Zealand in 1996

Bank of Melbourne in 1997

The 2000s

Westpac began the new century as a principal sponsor of the very successful Sydney 2000 Olympic Games. In 2002, the bank began a strategic reshaping commencing with the sale of its long-standing iconic finance company, Australian Guarantee Corporation Limited (AGC) to GE Australia. In the same year, it began to expand its wealth management business with the acquisition of:

Rothschild Australia Asset Management

Parts of BT Financial Group

51% of Hastings Funds Management Limited, moving to 100% ownership in 2005.

In 2008 Westpac merged with St.George Bank Limited, resulting in a much larger multi-brand Group. The effective date of the merger was 1 December 2008 and, 0n 1 March 2010, The Westpac Group commenced operating as a single authorised deposit-taking institution (ADI), and the legal entity St.George Bank Limited was deregistered. From that date St.George Bank became an operating division within The Westpac Group. On 25 July 2011, Westpac Group, through its operating division, St.George Banking Group, launched the Bank of Melbourne.

.

RURAL & INDUSTRIES BANK – BANK WEST

In 1916, the Agricultural Bank of Western Australia amalgamated with the Industry Assistance Board to form the Rural & Industries Bank of Western Australia. This amalgamation was done under the Rural & Industries Bank of Western Australia Act 1916. (also known as R&I Bank). In 1945, the Agricultural Bank became a full trading bank. This enabled it to expand its retail and commercial banking services throughout the state. The name was changed to BankWest in May 1994 and was fully privatisation on 1 March 1996.

.

ANZ BANK

.

.

NATIONAL BANK

.

.

COMMERCIAL BANK

.

.

IN THE NEWS

BANKING DEVELOPMENT AT KATANNING.

Great Southern Herald

13 July 1910 – P3

By advertisement last Saturday and today two of the strongest Banking Companies in the Commonwealth announce developments at Katanning. The Union Bank of Australia invites tenders for substantial banking premises on the fine new site recently purchased next to the Post Office. The Bank of New South Wales announces the opening of a branch in temporary offices in Albion Street, pending the selection of a central site, and erection of premises. It is hardly necessary to mention that the Western Australian Bank and National Bank have already substantial premises in the town.

The New South Wales Bank’s entry into Katanning maybe taken as an evidence that the prospects of the district commend themselves to the shrewd minds directing that business concern. The people of Katanning have never been chargeable with belittling their district, and they may well be gratified to find their estimate so practically endorsed by unbiased financial authorities.

Katanning must not, however, claim undue kudos for these evidences of banking favour. Similar enterprise on the part of the banks may be seen throughout the whole State. People who are not properly acquainted with banking methods may think that this enterprise is apt

to be too heroic. But the history of banking in Australia reveals exceedingly few mistakes. There have been a few mushroom companies doomed to failure from the inexperience of their managements and, in one or two instances, more solid companies of too adventurous policy have had to sound a retreat. But, on the whole, the banking business of these States has been careful as well as enterprising.

Banking administration is the most independent of business managements, and, largely because of that, it is the soundest. But there is also the element of safety which comes from careful training of its forces. Banking teaches men to combine firmness with grace in saying no.